It can seem trite to state that corruption has deleterious effects on economic growth and development. But it does. The key question, of course, is how best to generate incentives that move people away from engaging in corruption, and credible deterrents that sufficiently disincentive those who would be tempted. My job today is to demonstrate why we take this matter so seriously at Good Governance Africa; how tackling corruption advances our theory of change; what the economics literature has to say about corruption, and what can be done to address it.

The editorial in our recently released Africa in Fact defines corruption as the “abuse of power – and resources – by public servants and elected officials for private gain.” Of course, the practice is hardly confined to the public sector, hence the acknowledgement of “the company or CEO complicit in Illicit Financial Flows (IFFs), for whom paying bribes to the right officials to secure favourable mining concessions or lucrative government contracts is just part of the cost of doing business.” In this vein, the example of the late Markus Jooste of Steinhoff will suffice: “In 2016, the year before the Steinhoff debacle emerged, SA was ranked first in the world for the ‘strength of auditing and reporting standards’ in the World Economic Forum’s global competitiveness index. By 2018, we had plummeted to 55th”, reported Stuart Theobald last month in Business Day.

So why is corruption so destructive? It undermines the rule of law, bureaucratic quality, political stability, and the ability of a government to create an enabling environment for private sector dynamism to flourish and entrenches elite bargains that favour insiders at the expense of citizens.

Based on work by economists Daron Acemoglu and James Robinson, our theory of change at GGA is that strengthening government effectiveness and empowering citizens to hold their governments to account creates the enabling environment in which private sector dynamism can flourish and economies can grow sustainably. Government effectiveness is a function of healthy respect for the rule of law and regulatory quality. The World Bank describes the ‘rule of law’ as “perceptions of the extent to which agents have confidence in and abide by the rules of society, and in particular the quality of contract enforcement, property rights, the police, and the courts, as well as the likelihood of crime and violence.” It is clear how corruption would undermine such confidence. If companies can pay their way to obtaining licences or winning tenders, or judges take bribes to look the other way, then the very foundations of the rule of law are shaken.

Similarly, regulatory quality captures “perceptions of the ability of the government to formulate and implement sound policies and regulations that permit and promote private sector development.” Again, corruption diverts resources away from the implementation of policies that would otherwise promote private sector dynamism. In the South African case especially, the capture of the state by a private family through the vehicle of state-owned enterprises, has undermined the entire fabric of a nation and hollowed out the quality of the very institutions meant to prevent this kind of phenomenon.

To theorise for a moment, corruption tends to take root in weakly institutionalised contexts where enforcement capacity is limited. Douglass North and his co-authors, in a 2009 book called Violence and Social Orders, posited a ‘double balance’ between political and economic institutions on the one hand, and rent generation and distribution on the other. Elite bargains – agreements between elites to pool rents among each other at the expense of society – tend to be narrowest in countries where citizen voice is weakest. Elites often establish economic institutions that will generate rents that not only enrich the few, but also enable the suppression of civil liberties that would disrupt the double balance that animates the bargain. This in turn cements the political equilibrium that sustains the bargain. It is no accident that the World Bank defines ‘corruption’ as “perceptions of the extent to which public power is exercised for private gain, including both petty and grand forms of corruption, as well as “capture” of the state by elites and private interests.”

State capture in South Africa throttled the economy. The lag effects are still with us, and the economy grew at a sclerotic 0.3% in 2023. Forecasts are not optimistic that this growth will accelerate soon. In this context of weak growth and growing unemployment (especially among the youth), access to political office becomes highly sought after as it often offers the only apparent available income to desperate citizens. Political assassinations for access to office therefore start to increase, and organised crime flourishes as contract killing becomes big business and the rule of law deteriorates. One can therefore see how corruption throttles growth, often through the channel of creating political instability.

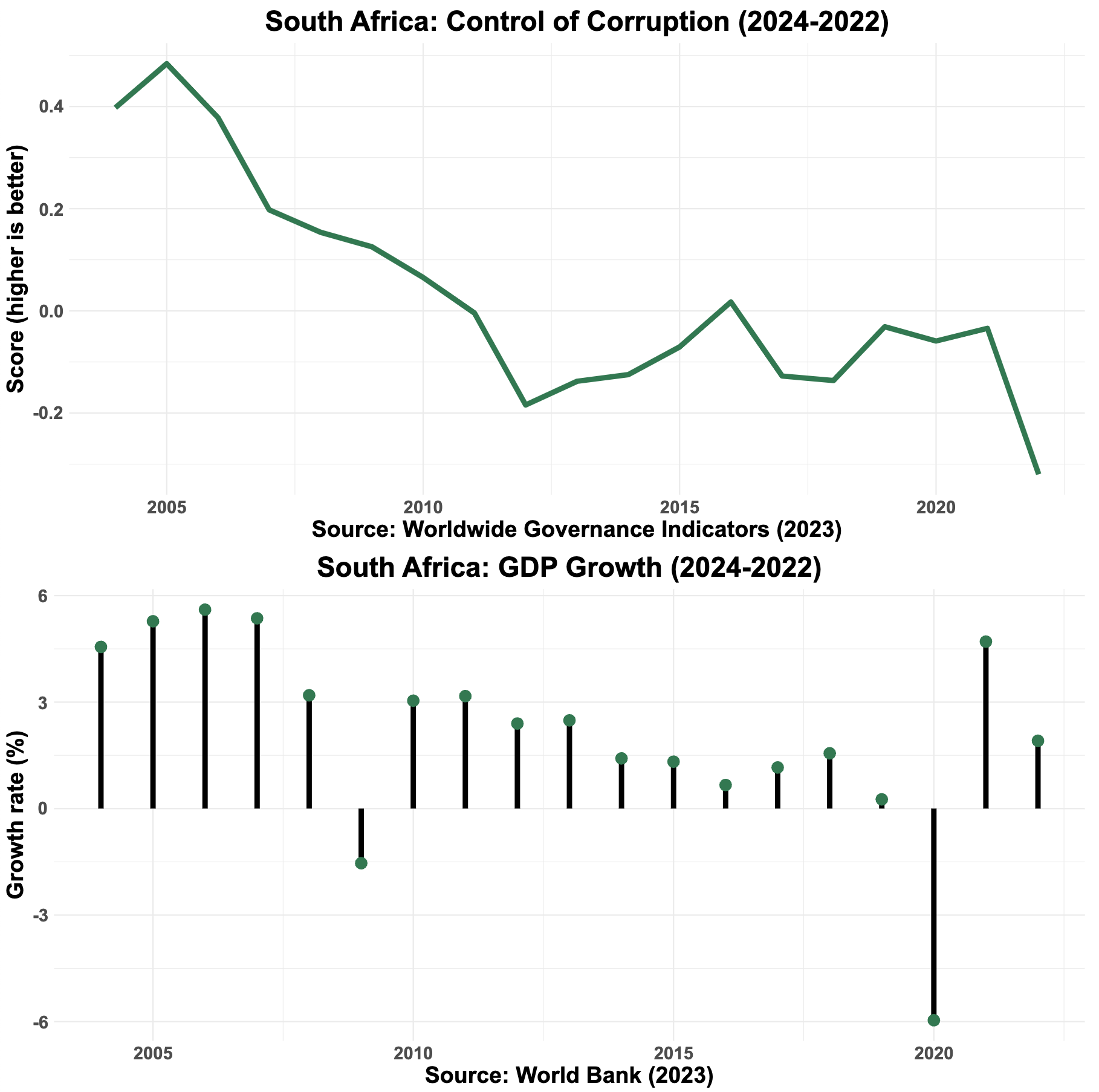

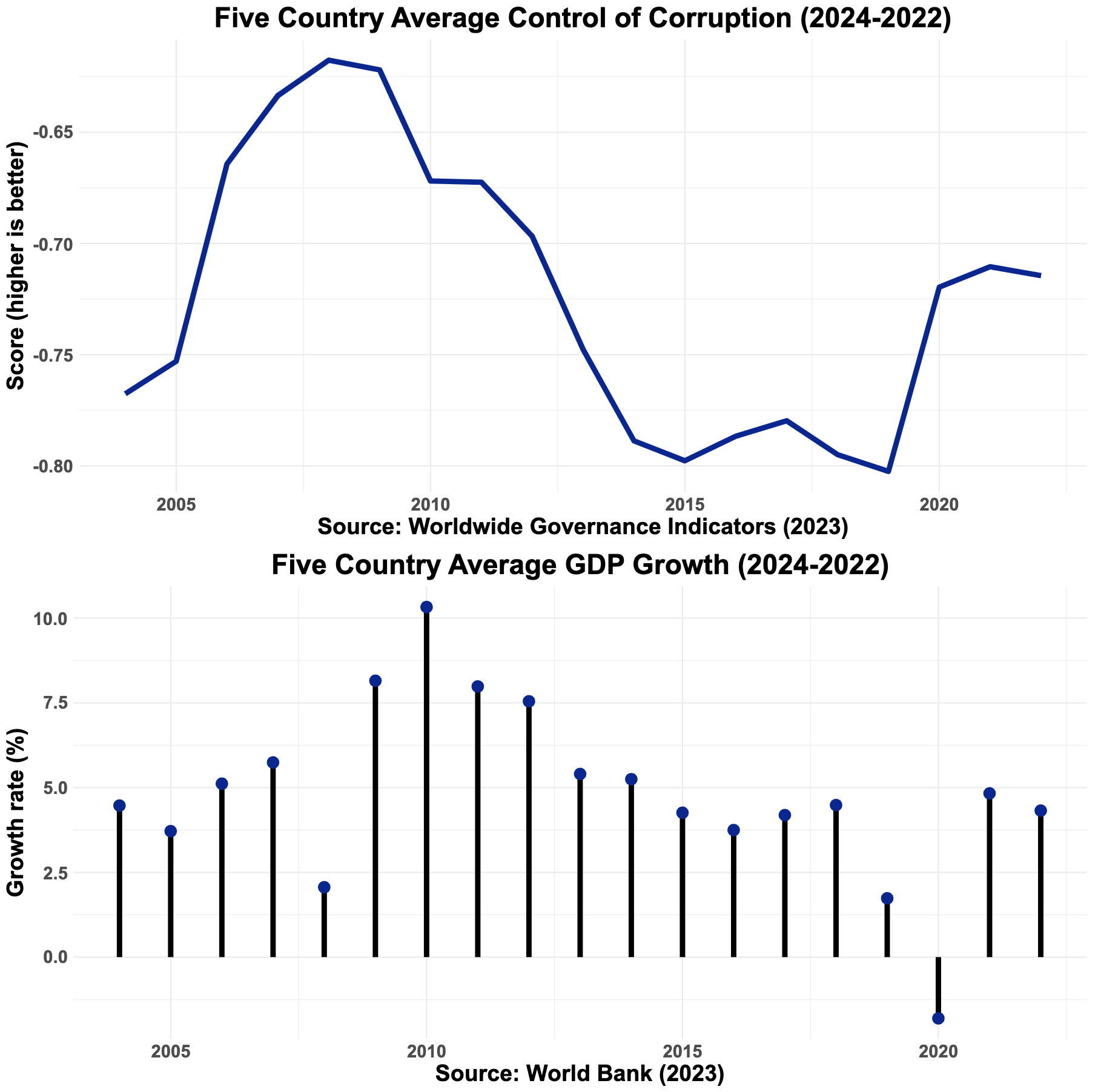

The graphs below indicate the extent to which corruption undermines economic prosperity. Correlation is not causation, but the data nonetheless tell a story that demonstrates the importance of cleaning out the cancer.

Economic growth in South Africa has closely tracked the state’s ability to control corruption. As corruption has grown, economic growth has deteriorated. One narrative, peddled by former president Zuma, was that this weak growth was entirely attributable to the global economic crisis of 2008. It also happened, however, to be correlated with the onset of state capture, which appears to be a more compelling explanation for the correlation seen in the graph above.

Startlingly, by way of contrast, Malawi, Mozambique, Tanzania, Zambia and Zimbabwe combined show a story of increased growth following improvements in controlling corruption. The fact that this story holds even with the inclusion of Zimbabwe is quite telling.

Global literature on the relationship between economics and corruption is varied, but one prominent paper from 2000 in the Journal of Comparative Economics (by Pak Hung Mo) recorded the following: “In our ordinary least squares estimations, we find that a 1% increase in the corruption level reduces the growth rate by about 0.72%… the most important channel through which corruption affects economic growth is political instability, which accounts for about 53% of the total effect.” The author also found that corruption reduces human capital levels, as well as the contribution of private investment to overall economic value. Without investment and human capital, you cannot have sustained growth.

Perhaps the most striking thing about the World Bank data pertaining to South Africa is that the country has fallen from a score of 76.3% (quite good) in 1996 to 44.8% in 2022, while Angola has made radical improvements (from a very low base of 5.7% in 2017 to 30.7% by 2022. Tanzania, similarly, has made good progress over the last few years and now ranks close to South Africa at 43.4%. Botswana has unfortunately seen a decline, but still ranks at 74.1%, which is by far the best score of the non-island southern African nations.

In Transparency International’s Corruption Perceptions Index of 2023, South Africa ranked 83rd out of 180 countries measured, scoring 43/100. Botswana, by way of contrast, ranked 39th, and scored 59/100. Denmark came first. The report states the following:

“The global trend of weakening justice systems is reducing accountability for public officials, which allows corruption to thrive. Both authoritarian and democratic leaders are undermining justice. This is increasing impunity for corruption, and even encouraging it by eliminating consequences for criminals. Corrupt acts like bribery and abuse of power are also infiltrating many courts and other justice institutions across the globe. Where corruption is the norm, vulnerable people have restricted access to justice while the rich and powerful capture whole justice systems, at the expense of the common good. Countries ranking high on the CPI have an impunity problem of their own, even if this isn’t reflected in their scores. Many cross-border corruption cases have involved companies from top-scoring countries that resort to bribery when doing business abroad. Others have implicated professionals who sell secrecy or otherwise enable foreign corrupt officials. And yet, top-scoring countries often fail to go after perpetrators of transnational corruption and their enablers.”

The Harvard Growth Lab’s 2023 report on the South African economy details the specific dimensions of corruption that afflict development. First: “Political patronage has been a widespread problem, as documented by South Africa’s Judicial Commission of Inquiry into Allegations of State Capture, Corruption and Fraud in the Public Sector including Organs of State”, which we know as the Zondo Commission. The Harvard lab notes that in blaming state collapse on corruption and patronage, we should not overlook the role of ideology and resultant legislative gridlock that have also undermined the capability of the state. A recent piece in Business Day by Temba Nolutshungu reflects on Estonia’s remarkable recent success against this kind of phenomenon, partly informed by a strong “Chicago School” view of the importance of allowing free markets to flourish. Former Prime Minister of Estonia, Mart Laar, cited in Nolutshungu’s piece, wrote the following: “the rule of law is especially important in fighting corruption, one of the worst diseases of transition economies. Corruption thrives when public officials and private agents have much to gain and little to lose from taking a bribe, which is precisely the situation that exists in most transition countries. Uncertain or non-transparent rules, heavy regulation and pervasive controls give officials exceptional power, many opportunities to seek bribes, and a wide scope for appropriating public wealth.” Indeed this observation is also made by economists Daron Acemoglu and Thierry Verdier. In a 2000 paper, they argue that extending the size of the public bureaucracy, often with a view to correcting market failure, results in the very failure that it tries to prevent: “The possibility of corruption is likely to increase the size of government and public-sector wages, as compared to the case where corruption was not possible.” This is not to say that attempting to address market failures is futile, but rather that it only works when the failure is correctly diagnosed, the intervention is optimal and corruption presence is minimal.

The exact opposite is unfortunately all too familiar to us in South Africa. The Harvard Growth Lab goes on to note South Africa’s steady decline in its ability to control corruption. The decline accelerated under the Zuma presidency, but it did not start then. This data is substantiated by a substantial growth in public perception that we are not fighting corruption effectively. In 2008, roughly 40% of respondents to Afrobarometer surveys reported that they thought government was handling corruption very badly. By 2021, that number had grown to 60%.

Harvard’s researchers rightly note that the “primary channel through which the collapse of state capability has undermined economic growth is through the deterioration of core functions of SOEs”. Corruption deeply underpins SOE mismanagement and financial distress. Like a river finding the path of least resistance, corrupt individuals were able to exploit poor governance structures in our SOEs to both generate rents and deepen corruption even further to the point where corruption was the only grease keeping the system working. And, as we all know, the kinds of corruption seen at entities like Eskom do not disappear overnight simply because we have had a Commission of Inquiry.

One of the key points made by the Harvard Growth Lab, which is critical to understand, is that corruption is an insidious phenomenon that takes on very different forms, and almost always flourishes where governance mechanisms are weak. These weak mechanisms do not always precede corruption, but sometimes the mechanisms are weakened by those who want to make corruption easier. For instance, our state-owned entities have a fundamental governance problem. In the words of Professor Alex van den Heever: “Our current government shareholder model for SOEs is deeply flawed and designed to fail because it allows for an easy entry route into these patronage and procurement opportunities.” Clearly, we require a separation between SOE leadership and the government. Ideology also plays a role, and the Harvard review points to the strategic errors of building Medupi and Kusile power stations as an example. Relying on Eskom to build coal-fired mega stations was arguably the worst allocation of capital imaginable, given the advances in renewable technologies that were occurring at the time, and the globally recognised phenomenon of corruption in mega-infrastructure projects. Neither of those power stations are yet fully functional, and experts doubt that they ever will be. They have, instead, massively indebted Eskom, which has in turn made our electricity extremely expensive and unreliable. An apparent ideological commitment to coal, along with seeing SOEs as a key conduit for corrupt rent-seeking, have severely undermined our economic potential as a nation.

Again, this did not happen in a vacuum – the Zondo Commission found that the ruling party’s policy of cadre deployment actively helped to hollow out state capability and facilitate its capture. Harvard’s review cites a piece in the journal of Law, Democracy and Development by Professor Cornelis Swanepoel, in which he notes that even the President acknowledged in his submission to the Zondo commission, “a disturbing level of grand corruption, where individuals were placed in various institutions to manipulate procurement and other processes to siphon off massive amounts of funds for a network of politicians, public servants and businesspeople.” We have this extraordinary situation where the president himself has articulated the essence of an elite bargain that struck a cynical double balance to design (or undermine) political and economic institutions that generated rents for a select few, which were distributed to a narrow patronage network. Swanepoel concludes by stating that “cadre deployment, at least in the way it has been applied by the ruling party, is an enabler of much of our current woes.”

Corruption manifests in highly diverse ways and often proceeds to take on a life of its own. It operates like a virus that weakens the immunity of the host organ and proceeds to direct that organ to take governance decisions that are highly sub-optimal. It also seems to thrive in circumstances where decisions are made behind closed doors and where the decision-makers are somehow immune to accountability because they are politically protected.

This of course brings us to the question of what can be done. In a 1974 paper, now cited 3,418 times according to Google Scholar, Gary Becker and George Stigler – of the Chicago School – state the following: “There is a powerful temptation in a society with established values to view any violation of a duly established law as a partial failure of that law. Even economists long trained in the harsh realities of a world in which wishes far outstrip resources will be found lamenting the moral laxity that leads to widespread violation of law. Yet it surely follows from basic economic principle that when some people wish to behave in a certain way very much, as measured by the amount they gain from it or would be willing to pay rather than forego it, they will pursue that wish until it becomes too expensive for their purse and tastes. And in general, it will not be inexpensive for society to make prohibited behaviour expensive for the potential violator.”

Given that it is not inexpensive to limit corruption and improve enforcement efficacy against those who break the law, it is our view, at GGA, that one of the most powerful mechanisms by which to disincentivise corruption is to empower citizens to hold their governments to account. A critical mass of citizens pursuing accountability and driving prosecution will render the malfeasance increasingly costly. This begins at the ballot box, but it cannot end there. Citizens need to both defend their freedoms of association and expression in the first instance, but also use those freedoms to make corruption prohibitively expensive for those who would perpetrate it.

Dr Ross Harvey is a natural resource economist and policy analyst, and he has been dealing with governance issues in various forms across this sector since 2007. He has a PhD in economics from the University of Cape Town, and his thesis research focused on the political economy of oil and institutional development in Angola and Nigeria. While completing his PhD, Ross worked as a senior researcher on extractive industries and wildlife governance at the South African Institute of International Affairs (SAIIA), and in May 2019 became an independent conservation consultant. Ross’s task at GGA is to establish a non-renewable natural resources project (extractive industries) to ensure that the industry becomes genuinely sustainable and contributes to Africa achieving the Sustainable Development Goals (SDGs). Ross was appointed Director of Research and Programmes at GGA in May 2020.