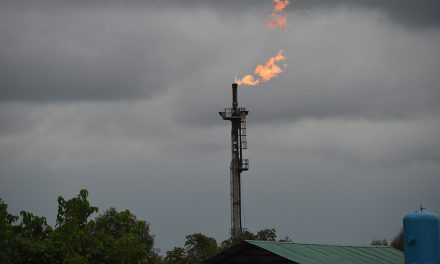

Nigeria’s informal sector consists of several artisans, traders, shop owners and market women and men. Unlike the formal sector where it is easier to track and collect Pay as You Earn (PAYE), Value Added (VAT) and Withholding (WHT) taxes, the informal sector is a big, potential taxable businesses and services pool. However, it has been extremely difficult for successive Nigerian governments at the federal, state and local levels to devise an effective means of tax collection which extends fully to the informal sector. Yet, the incipient shift away from Nigeria’s oil dependency creates significant scope for building a more efficient tax system that will effectively bring informal economic activities into the tax net. Click below to download the full report.