Opinion from GGA-WARO: After months of intense debate on various public platforms in Ghana over the dire economic situation in Ghana, the Akuffo Addo-led government of Ghana finally seeks a bailout from the International Monetary Fund (IMF). On the 1st of July 2022, the Government of Ghana formerly wrote to the Bretton Woods Institution (IMF) concerning its decision to engage the latter for a possible financial bailout to restore macro-economic stability and safeguard debt sustainability for the country. IMF’s Resident Representative in Ghana, Dr. Albert Touna-Mama has since confirmed that the Ghanaian authorities had reached out to the Bretton Woods Institution and that the IMF is ready to assist the country. This announcement by both the Government of Ghana (GoG) and IMF, follows a huge public outcry and intense debate on the economic situation in Ghana characterized by the sharp rise in the prices of commodities (with food amongst the top most affected), a persistent rise in fuel prices and the continuous fall in the value of the country’s currency (the cedi).

Arise Ghana demonstration (Ghanaians demonstrate over rising cost of living and economic downturn)

Background to Ghana’s request to the IMF

President Nana Addo Dankwa Akufo-Addo – President of the Republic of Ghana

The Government of Ghana led by H.E. Nana Addo Dankwa Akuffo Addo had since the beginning of the year 2022, intimated strongly its commitment to design and initiate a home-grown economic recovery program to return the country back to its pre-COVID economic status. To the government, the option of seeking another economic program from the Britton Woods Institution was not an option. This position from the hind side was consistent with the position of the government when it was in opposition. Remember in the year 2015, Ghana then led by the NDC government under the leadership of H.E. John Dramani Mahama (Ghana’s immediate past president), had taken the country to the IMF for a three-year program for an estimated $ 918 million. This followed what the IMF described as “…., Ghana’s economy was in trouble, hobbled by widening current account and budget deficits, rampant inflation, and a depreciating currency. Credit dried up as interest rates rose and banks’ bad loans piled up. At the root of Ghana’s woes was out-of-control government spending, largely to pay salaries of an overgrown civil service” 1.

The 2015 IMF-Ghana program was mainly hinged on three areas of economic intervention namely, i) restoration of debt sustainability; ii) strengthening of monetary policy; and iii) cleaning up of the banking sector (IMF, 2019). The Akuffo Addo-led administration had criticized the previous government for economic mismanagement leading to the $ 918 million intervention and called for a paradigm change in the country’s economic governance based on home-grown policies; “Ghana Beyond Aid”. This, the current government promised will be a major policy shift it will be embarking on, should it win the 2016 general elections in Ghana. Upon assumption of power in January 2017, the NPP-led administration was seen to be working to end the IMF programs earlier than the scheduled end date, when they had series of engagements. This was not to be; rather, an extension of the program was secured from 30th August, 2017 to 2nd April 2019 2.

Ghanaians are generally weary of interventions of the Breton Woods institutions especially the IMF since from experience, it always came with restrictive conditionalities.

Therefore, following the successful completion of the last IMF program in 2019, Ghanaians sighed a big relief as it marked what was viewed by many as the beginning of the opening of the economy due to the lifting of those restrictions posed by conditionalities of the program. Furthermore, since the new NPP government introduced many of its flagship programs such as the industrialization policy (“one-district-one factory”), “planting for food and jobs”, automobile transformation agenda, etc., Ghanaians have been hesitantly optimistic of a brighter economic future with little or no directives from the Bretton Woods Institutions. The dreaded period of the last IMF program (2015 to 2019), where public sector recruitment was restricted and the government’s expenditures were limited as part of the conditionalities, in the opinion of many, hampered the opening up of the economy of Ghana.

The return of the NPP government to IMF, three years after the last program, therefore, is facing a lot of public backlash as this is seen by some Ghanaians as a total failure by the current administration. There are however some who see the IMF intervention as inevitable, considering the impact of the unfortunate external factors such as the COVID-19 and the Russian-Ukraine war and therefore seeking the intervention is the surest way to restore investor confidence in the economy of Ghana.

Dr. Mahamudu Bawumia – Vice President of the Republic of Ghana and Chairman, Economic Management Team

Inflation and the Rising Cost of Living

According to the Ghana Statistical Service (GSS), the Producer Price Inflation (PPI) rate for May 2022 was 33.5 percent. This rate indicates that between May 2021 and May 2022 (year-on-year), the PPI increased by 33.5 percent. This rate represents a 2.1 percentage point increase in producer inflation relative to the rate recorded in April 2022 (31.4%) 3. The sharp rise in inflation in Ghana is worsening the plight of ordinary citizens and hence a public outcry for the government act quickly on the situation. Most affected areas of the economy include the cost of basic commodities with food being one of the hardest-hit areas. Cost of transportation, building materials and the cost of utilities are also, among the concerns of the people. Whilst government is blaming the dire situation on the novel COVID-19 global pandemic and the recent Russia-Ukraine war, some economic analysts and development actors are blaming the situation on the government’s failed policies and mis-governance. The GGA-WARO economic governance lens has captured critical analysis of the economic situation by external economists such as Professor Steve Hanke, a renowned economist at the Johns Hopkins University, USA, who is quoted to have estimated Ghana’s current inflation to be at 49.35 percent. This is a sharp contradiction to the official GoG figure put up by the GSS. However, Prof. Hanke’s assessment may tie in well with many Ghanaians analysists who believe the managers of the economy are being charitable with the true state of the country’s economy. The persistent rise in the prices of goods and services in Ghana has led to a unified outcry from all segments of the population. Employee Unions and other Business Associations are registering their displeasure with the economic state of affairs which they claim are eroding their investments, making it difficult to plan and generally reducing the standard of living.

Continuous Fall of the Ghana Cedi, Fuel Price Hikes and Matters Arising

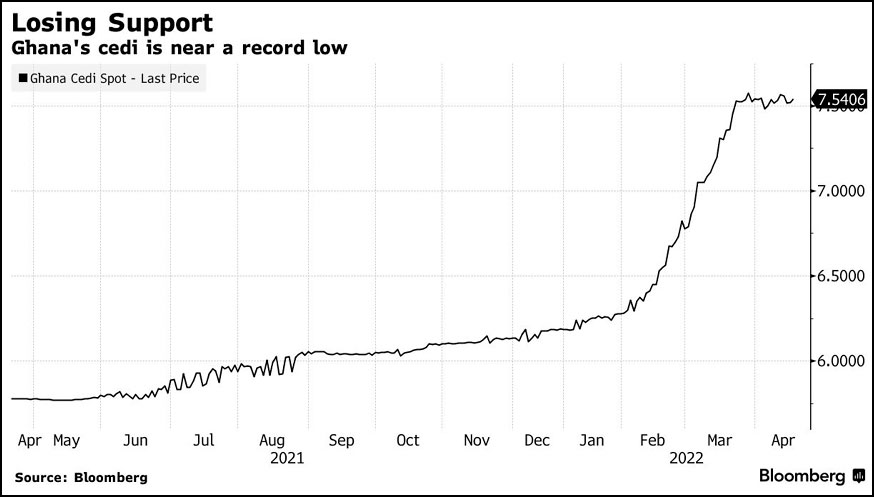

The Ghanaian currency (cedi) persistent decline in terms of value against major trading currencies like the US Dollar, Euros and the Pound Sterling continues unabated. Ranked as one the poorest performing currencies globally for the most part of the year 2022, the Ghana Cedi’s depreciation is seen as one of the major causal factors for the rise in inflation. The Ghanaian economy remains largely an import-driven economy though attempts are being made to change the narrative. The current government’s support for an industrial revolution through its flagship programs such as the ‘one-district-one factory’ 4, automobile manufacturing concessions, and the ‘planting for food and jobs’ 5 are all geared toward local production and export. These measures are expected to reduce significantly the importation of goods and services that can be locally produced whilst increasing the production of exportable products in Ghana. By this, the country is expected to reduce demand for foreign currencies for imports thereby reducing the pressure on the Cedi. Unfortunately, post-COVID, Ghanaians are seeing the worsening depreciation of the Cedi which in effect is affecting all aspects of life in Ghana.

The Cedis’ continuous depreciation is greatly impacting the prices of general goods and services (which are normally imported). One hardest hit area linked to the depreciation of the cedi is the rise in the cost of fuel. The fuel price hikes, which the government is also blaming on the Russia-Ukraine war is having direct impact on the cost of transportation and commodities. Bloomberg describes the performance of the Cedi this year as the worse performing African currency after the Zimbabwe Dollar. Analysis from the leading business and financial data, news and insight agency put the percentage depreciation of the Ghana Cedi at 18% with projections of further depreciation as the months go by this year 6.

Ghana’s cedi is near a record low

Ghana’s Debt to GDP Ratio

Another area of concern in the analysis of Ghana’s current state of the economy has to do with the country’s rising debt stock. Ghana’s public debt stock remarkably shot up by ¢40.1 billion to ¢391.9 billion as of the end of March 2022, the Summary of Economic and Financial Data by the Bank of Ghana has revealed (GoG, 2022). This significant rise, the managers of the economy blame partly on COVID 19 related expenditures. The IMF for instance has forecast Ghana’s debt to GDP ratio to hit 84.6% by the end of 2022. Some observers have described it as unsustainable and even in some cases branded the country as a debt-distressed nation. It is feared that the situation may discourage investors who may fear the inability of the West African nation to honor its maturing debts. This situation resulted in attempts by the GoG to attempt to use an inward-looking approach to raise needed funds for its operations. One such attempt is the introduction of the electronic levy (popularly referred to as the Momo tax or E-levy). The E-levy which was fiercely resisted by sections of the population but finally passed by the government is a 1.5 percentage levy on all electronic financial transactions. Unfortunately, a few months into its passage, revelations are emerging that the tax is currently raking in just 10% of its anticipated revenue to the government. This latest revelation many believe is one of the main reasons why the GoG has finally applied for liquidity support from the Bretton Woods Institution.

Prospects of a New IMF Programme for Ghana

Following the July 1st formal application of the GoG to the IMF, IMF has confirmed the receipt of Ghana’s application for support to restore macroeconomic stability and safeguard debt sustainability. The announcement by the GoG and later the IMF, has been met with mixed reactions. Different segments of the Ghanaian population are reacting to the news in varied ways. Workers’ Unions are already skeptical about the prospects of such a program and are already indicating their resolve to resist any attempts by the government to accept a program with conditionalities that will not augur well for their members. Ghana’s Minister for Trade and Industry, Hon. Alan K. Kyeremateng in a meeting with captains of industries in Ghana is quoted to have said that the decision to go to the IMF is a good one though he concedes that the move will not necessarily bring about prosperity but macro-economic stability. Among the most dreaded conditionalities that such a program might bring are the potential freeze on public sector employment; where most Ghanaian youth depend on for employment after graduation from Universities and the chances that those already in the system may not receive any increment in emoluments for the period of the program. Governments’ expenditures are also predicted to be limited which many fears will affect negatively business growth and expansion as well as infrastructure development.

Meanwhile, to proceed with the engagements between the IMF and the GoG, a team from the Bretton Woods Institution is expected to land in Ghana on the 6th of July to commence negotiations on July 7th.

The GoG has since announced a strong Communication Team who are being deployed to the various media outlets to explain the government’s decision to finally seek support from the IMF after weeks and months of resisting suggestions from various groups to do so.

The GGA-WARO economic governance desk will be monitoring conversations and reports on Ghana’s negotiations with the IMF and is particularly looking out for how the GoG manages to protect the interest of Ghanaians and sustain some of its flagship programs.

[activecampaign form=1]

[1] IMF Lending Factsheet (May 2019): IMF Program Helps Restore Luster to a Rising Star in Africa. https://www.imf.org/en/Countries/GHA/ghana-lending-case-study

[2] GoG/MoF (2019). IMF Executive Board Completes the Last Review of Extended Credit Facility for Ghana. https://mofep.gov.gh/news/2019-03-21/IMF-executive-board-completes-the-last-review-of-extended-credit-facility-for-ghana

[3] GSS Ghana official data (retrieved on 04/07/22). Newsletter Producer Price Index (PPI) May 2022. Website: https://www.statsghana.gov.gh/

[4] One-district-one-factory policy of the NPP Government is to create the enabling environment for the setting of up of at least one industry each in Ghana’s 275 districts. Under the policy, government is creating the conducive environment for private sector investment into industrial production.

[5] Planting for Food and Jobs refers to the NPP Government’s agricultural policy to increase investment in the agricultural sector to produce food to feed the country and for export whilst creating jobs for the people.

[6] Chinchalka, A. (2022). History Shows Ghana’s Cedi may Weaken Further from Record Low. https://www.bloomberg.com/news/articles/2022-04-21/history-shows-ghana-s-cedi-may-weaken-further-from-record-low